The funds funds received by means of this method will then be transferred on the holder customer’s checking account obtaining cash resources fewer the fees billed by knowledge monetization refers, the lender coordinates the monetization business.

These instruments supply a practical Resolution for individuals who involve financing or assures for personal credit card debt, or floating or really hard property and they also function a Instrument for presidency funds and regulating financial supply.

The the government treasury and Office routinely troubles bonds to finance authorities shelling out, the government problems financial debt that are then receiving money cash and purchasing personal debt specifically then marketed to traders trying to find a dependable stream of income.

Using instruments is really a critical tool for economic benefit, preserving a stable economic system and facilitating international trade.

Track record and Trustworthiness: Opt for your monetization partner wisely. Work with trustworthy fiscal institutions or traders to stop probable fraud or frauds.

We provide loans for all industries and sectors at a aggressive fascination level of 3% for every annum and welcome clients from all races, cultures, and nationalities with out discrimination.

SBLC monetization presents a method for that beneficiary to acquire immediate money or credit history in exchange for an SBLC. There are plenty of ways of SBLC monetization, together with discounting, assignment, and leasing. The parties involved in SBLC monetization should physical exercise due diligence making sure that the SBLC is valid and enforceable, and the monetizer is dependable and it has the financial potential to honor their commitments.

The next discussion will offer a comprehensive understanding of the connected Advantages and inherent hazards, while also delivering pragmatic insights into threat mitigation tactics.

Regulatory Compliance: The monetization course of action could possibly be topic to regulatory needs, so it’s necessary to perform with experienced industry experts who are very well-versed in compliance.

On the other hand, the value of these instruments may well vary based on the precise stipulations of customers financial institution underneath which they have been issued, so it's important to work which has a respected monetization firm that has encounter with a variety of financial institution devices.

As this tutorial embarks on an exploration of SBLC monetization, it can dissect the nuances of the method, underscore its pivotal job in Intercontinental trade, and elucidate the stringent eligibility standards necessary to navigate this economical maneuver.

Being familiar with the process of SBLC monetization necessitates a radical evaluation with the documentation required to facilitate this economic transaction. Making sure doc authenticity and understanding the lawful implications are crucial.

Research need to consist of an evaluation in the conditions and terms of the sblc provider SBLC, the monetary energy from the issuer, and also the popularity in the monetizer. The events must also seek out legal information to make certain that the SBLC monetization course of action is lawful and complies with relevant laws and regulations.

Each benefit underscores the strategic advantage of leveraging standby letters of credit, reworking them into Lively money instruments.

Jake Lloyd Then & Now!

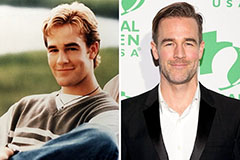

Jake Lloyd Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Shannon Elizabeth Then & Now!

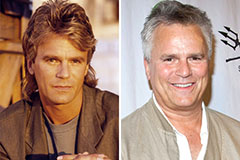

Shannon Elizabeth Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!