A fiscal SBLC is definitely the most often made use of kind of secondary guarantees. It mitigates the chance of default for the seller, as huge trade agreements have superior financial risks.

As a result, the seller is certain to be compensated. A different edge for the vendor would be that the SBLC lowers the risk of the creation purchase getting modified or canceled by the buyer.

However, it’s vital that you Be aware which the issuing or monetization banker or legislation business may perhaps have to have supplemental time according to different things, such as the consumer’s aims, marketplace ailments, other specials during the queue, place on the globe, and credit availability of your monetizer.

The Bottom Line A SBLC is a powerful Resource for companies negotiating huge specials for merchandise or expert services. While using the backing of a business bank, an SBLC gives reassurance that an agreement will go through, even in a very worst-situation scenario. But a SBLC will not be without cost—you'll find fees, and also your creditworthiness will likely be assessed.

We facilitate the issuance of standby letters of credit to help major transactions and enrich credit.

A Standby Letter of Credit (SBLC / SLOC) is often a ensure that is made by a lender on behalf of the consumer, which assures payment will be manufactured regardless of whether their customer are unable to fulfill the payment. It is a payment of very last vacation resort in the financial institution, and ideally, is rarely intended to be used.

The process of having an SBLC is fairly SBLC MONETIZATION similar to making use of to get a commercial mortgage. Having said that, In such a case, the bank could ask for a few collateral (a thing beneficial) as security In the event the applicant can’t spend back the amount.

Letters of credit are sometimes referred to as negotiable or transferrable. The issuing lender can pay a beneficiary or perhaps a lender that is certainly nominated through the beneficiary. As being the beneficiary has this power, They might ‘transfer’ or ‘assign’ the proceeds of a letter of credit to a different enterprise.

Our target extends beyond mere transactions; we wish you to definitely certainly be a key husband or wife in achieving your online business targets. By harnessing our large encounter, methods, and modern solutions, AltFunds Worldwide Corp stands ready To help you in reaching your strategic plans.

The financial institution guarantees to pay the total or remaining sum for the exporter when they satisfy all of the circumstances of the SBLC arrangement. This ensures that the seller receives paid as long as they do every thing as agreed.

By familiarizing your self Using these formats, it is possible to far better understand the stipulations in the instrument and be sure that every little thing is in order before proceeding which has a transaction.

The beneficiary can then use the financial loan cash to the intended intent.Monetary Devices: In some cases, the monetization partner may well give economical instruments, like bank guarantees or letters of credit, that may be used by the beneficiary in trade or other money transactions.

Standby Letters of Credit (SLOC) are very important monetary devices in Global trade and domestic transactions, offering a assure that obligations is going to be achieved. They foster have faith in concerning companies or entities engaged in considerable contracts.

It can be accustomed to assure the vendor from the monetary abilities of the customer. It might be a helpful belief tool in substantial trade contracts, where by the buyer and vendor have no idea each other.

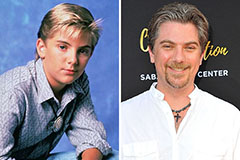

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!